Accounting

settingsIf you like to work with numbers and have a knack for analysis and problem solving, a career in accounting might be for you.

Overview

OFTC’s Accounting programs include sequences of courses that prepare students for careers in today’s technology-driven workplaces. The skills students acquire in this program help them secure a job, excel, and advance in the field. Students obtaining an Accounting Associate of Applied Science Degree will be able to enter the workforce as accountants with the skills necessary to handle an array of financial and managerial accounting tasks, including maintaining a set of books for business entities, current and long-term liabilities, cost behavior and cost-volume-profit analysis budgets, capital investment analysis, and many more.

Accounting skills are needed at every company, and every department within those companies is impacted by the work of the accounting team. By choosing a career in accounting, you’re choosing a stable environment to make a great living!

Programs in the Accounting department can be completed between 2 – 5 semesters.

Programs

Accounting Associate of Applied Science Degree

Accounting

Associate Degree

5 Semesters

The Accounting associate degree program is a sequence of courses that prepares students for careers in accounting in today’s technology-driven workplaces. Learning opportunities develop academic, technical, and professional knowledge and skills required for job acquisition, retention, and advancement. Program graduates receive an Associate of Applied Science Degree in Accounting.

Accounting Diploma

Accounting

Diploma

4 Semesters

The Accounting diploma program is a sequence of courses that prepares students for careers in accounting in today’s technology-driven workplaces. Learning opportunities develop academic, technical, and professional knowledge and skills required for job acquisition, retention, and advancement. Program graduates receive an Associate of Applied Science Degree in Accounting.

Accounting Fundamentals Technical Certificate of Credit

Accounting

Certificate of Credit

2 Semesters

The Accounting Fundamentals technical certificate of credit exposes students to the most foundational topics of the accounting profession. The accounting coursework exposes students to the basic tenets of financial accounting and income tax law.

Computerized Accounting Specialist Technical Certificate of Credit

Accounting

Certificate of Credit

2 Semesters

The Computerized Accounting Specialist technical certificate of credit provides students with skills needed to perform a variety of accounting applications using accounting software and practical accounting procedures.

Office Accounting Specialist Technical Certificate of Credit

Accounting

Certificate of Credit

2 Semesters

The Office Accounting Specialist technical certificate of credit provides entry-level office accounting skills. Topics include: principles of accounting, computerized accounting and basic computer skills.

Payroll Accounting Specialist Technical Certificates of Credit

Accounting

Certificate of Credit

2 Semesters

The Payroll Accounting Specialist technical certificate provides entry-level skills into payroll accounting. Topics include: principles of accounting, computerized accounting, principles of payroll accounting, mathematics and basic computer use.

Tax Preparation Specialist Technical Certificates of Credit

Accounting

Certificate of Credit

2 Semesters

The Tax Preparation Specialist technical certificate of credit is designed to provide entry-level skills for tax preparers. Topics include: principles of accounting, tax accounting, business calculators, mathematics, and basic computer skills.

Features

Job Stability & Security

As long as people need help with taxes and businesses exist, there will be a need for accounting-related jobs. Bookkeeping, Accounting, and Auditing Clerks can work in a variety of industries and roles with job security, opportunities for growth, and excellent earning potential.

Little or No Cost to You

Various grants and scholarships are available to help make OFTC an affordable choice. Ask about program-specific opportunities for financial aid and payment plans.

Tuition & Fees

With tuition at $107 per credit hour, total costs for Accounting department programs range from:

- Tuition & Fees*: $2,062.00 – $8,155.00

- Books & Supplies*: $500.00 – $2,400.00

*Visit the OFTC Catalog to view each individual program and its full breakdown of tuition, fees, books, and supplies. Costs are estimated and are subject to change.

Advancement Opportunities

The Accounting industry is always evolving, meaning people employed in this field are constantly learning new things. With the right combination of education, accounting skills, and experience, accountants can expand their career options by pursuing various specialized positions.

Locations

Oconee Fall Line Technical College has campuses throughout its 11-county service area. We look forward to your visit.

Online

Admissions

Our application process takes just a few minutes to complete, but we want to make sure you have the things you’ll need on hand to complete the application. We’re here to help if you have any questions!

Admissions Process

Your admissions application can be submitted online with your $25.00 non-refundable application fee and takes just a few minutes to complete.

- Submit a completed application and application fee.

- Submit official high school transcript, GED transcript, or official college transcripts, if applicable.

- Submit official entrance score on a validated assessment instrument, if applicable. Visit the OFTC Catalog Program Page to view each individual program and its required minimum scores.

- Complete the FAFSA (Free Application for Federal Student Aid) and HOPE applications online using OFTC School Code: 031555.

NOTE: The College may accept transfer credit for other courses according to the College’s transfer policy.

General Requirements

Be at least 16 years of age.

Additional admissions requirements unique to each program are listed on each individual program page in the OFTC Catalog.

Need More Info?

For more information about any of these programs, contact a program advisor:

Sandersville Program Advisor

Dublin Program Advisor

For additional information on admission to OFTC, contact the Office of Admissions:

Sandersville Office of Admissions

Dublin Office of Admissions

Learning Format

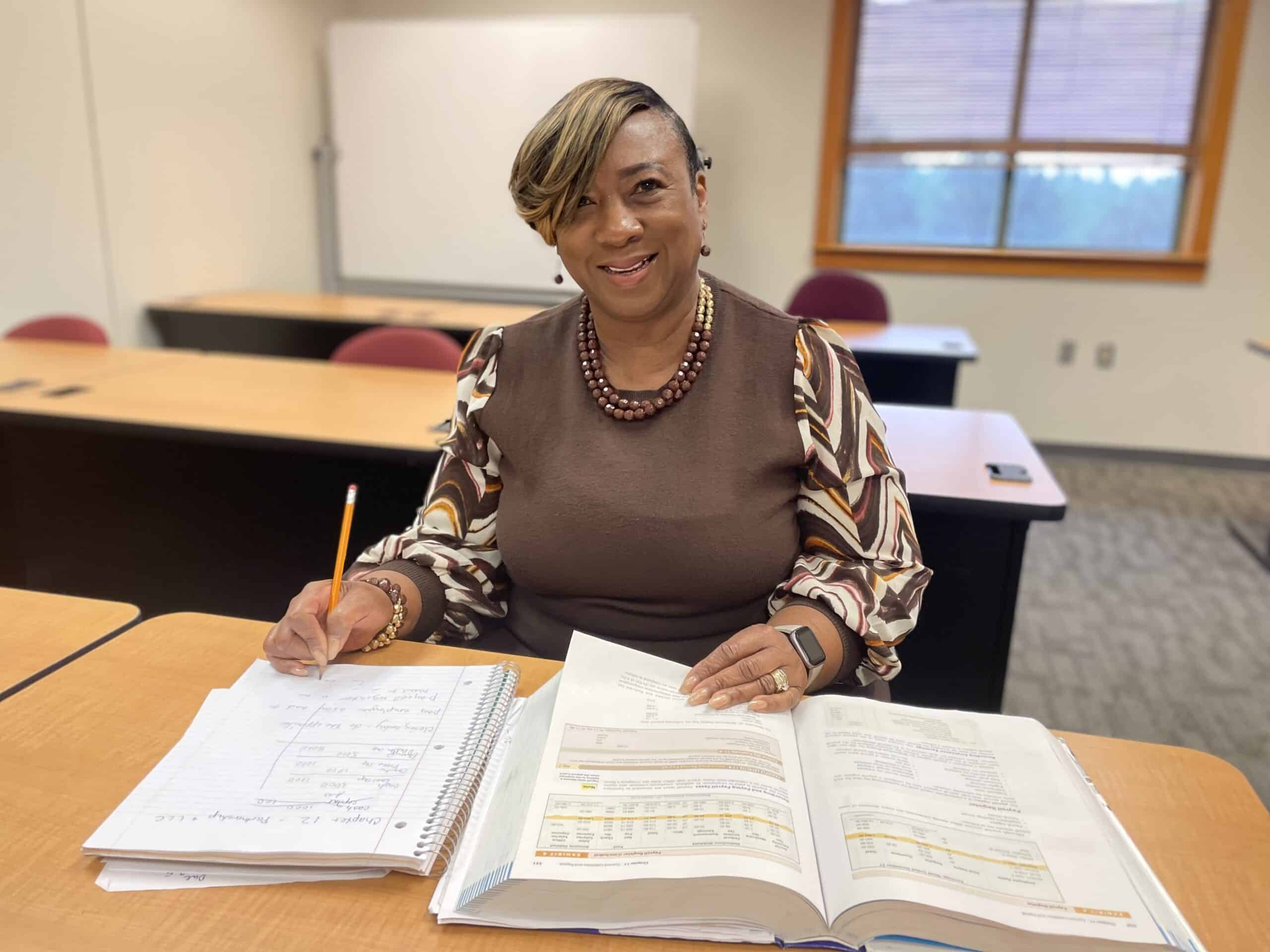

Students can enter an accounting program any semester — because when you’re ready to start on your path towards a new career and change your life, there’s no reason to wait.

Classes are offered in a variety of formats: on campus, blended, online asynchronous, and synchronous technology.

On Campus

These are courses that are taught primarily in the classroom or lab with less than 50% of instruction online. On campus courses may include lecture, labs, internships, clinicals, and other in-person instructional modalities.

Blended

Blended courses are distance learning courses with the majority of the course content, activities, and interactions occurring online but may require students to come to campus for specific assignments, activities, or events.

Online Asynchronous

These are courses that are taught fully online asynchronously with course content, activities, and interactions occurring entirely online. This delivery method does not require students to be online at a specific date or time, and students may participate in class activities and complete course assignments asynchronously. Online asynchronous courses require proctored events.

Synchronous Technology

OFTC also utilizes synchronous technology to offer courses via distance education means. The course is taught on one campus and then broadcast simultaneously to a classroom on a different campus that is monitored by a class proctor.

Flexible Schedule

We want you to get the most out of college and understand the pressure it adds to your life. At OFTC you can achieve your career goals and fit college into your lifestyle. We offer small class sizes and flexible scheduling.

Courses for our programs are offered during the morning, afternoon, and evenings – plus many are online where you can do your work any time of day.

And the personalized hands-on attention you receive in a small classroom setting allows you to get individualized support, focus and feedback from your instructors. Your instructors will get to know you and help you build the foundation and confidence needed for success in your field.

Apply TodayPaying for College

At OFTC, we realize that many students require financial assistance to achieve their academic goals. We’ll work with you to help you obtain financial aid to assist you in funding your education. We’re committed to helping you find ways to pay for this life-changing investment.

With the Pell Grant, Georgia’s HOPE Grant, HOPE Scholarship, and HOPE Career Grant (for students/programs who qualify) and other scholarship opportunities, many students graduate OFTC with little to no debt.

Financial Aid

OFTC offers several financial aid opportunities that can help you pay for college. Most students apply for federal and state aid, including the Pell Grant, HOPE Scholarship & Grant, and HOPE Career Grant.

OFTC students can also apply for scholarships through the OFTC Foundation and various businesses and civic-sponsored organizations.

Contact the Office of Financial Aid or visit OFTC’s Financial Aid web page to learn more about grants, scholarships and Federal Work Study to help fund your education.

Sandersville

Dublin

Georgia awarded over $934 million in scholarships in AY24

of OFTC students have some form of scholarship in AY24

OFTC students received over $8.4 million in financial assistance in FY25

More than 75% of OFTC students received some sort of Financial Aid in AY24

Contact

Sandersville

Dublin

Tuition & Fees

With tuition at $107 per credit hour, total costs for Accounting department programs range from:

- Tuition & Fees*: $2,062.00 – $8,155.00

- Books & Supplies*: $500.00 – $2,400.00

*Visit the OFTC Catalog to view each individual program and its full breakdown of tuition, fees, books, and supplies. A budgeted cost of attendance is also available. Costs are estimated and are subject to change.

New Price Calculator

You can also use the Net Price Calculator to get estimated net price information based on what similar students paid in a previous year.

Career Outlook

Graduates of OFTC’s Accounting programs are prepared for careers such as bookkeepers, accounting technicians, payroll or data entry clerks, and accounts payable/receivable clerks. Certificate holders may also qualify for roles like tax preparer, depending on the program.

BLS.GOV

Bookkeeping, Accounting, and Auditing Clerks (some college no degree)

- 2024 Median Annual Pay: $49,210

What does this mean to you?

Good jobs are available in every industry for accounting related skills requiring less than a 4-year degree.

Learn More

job placement rate for OFTC graduates within the graduation year (AY23)

in-field job placement rate for OFTC graduates within the graduation year (AY23)

of OFTC students enrolled are First Generation college students (AY24)

Program Benefits

Skills Learned

- Use bookkeeping software, spreadsheets, and databases

- Enter (post) financial transactions into the appropriate computer software

- Receive and record cash, checks, and vouchers

- Put costs (debits) and income (credits) into the software, assigning each to an appropriate account

- Produce reports, such as balance sheets (costs compared with income), income statements, and totals by account

- Check for accuracy in figures, postings, and reports

- Reconcile or note and report any differences they find in the records

Job Titles

- Bookkeepers

- Accounting Technicians

- Data Entry Clerks

- Payroll Technicians

- Accounts Payable Clerks

- Accounts Receivable Clerks

Diverse Settings

- Health Care

- Financial Services

- Government

- Consumer Goods

- Tax Preparers

- Insurance

"Accounting plays a vital role in every organization. Accounting is the process of recording, summarizing, analyzing, and interpreting financial data. Without skilled accounting professionals to oversee this process the organization cannot know where it currently stands, where it has been, or where it is going."